Studyng Failure

One striking thing about the finance reading I'm doing is that you study failures - lots of them. The biggest lessons come from case studies of the biggest fuckups.

This is very different than physics, where people hardly ever talk about the failures.

It's too bad, because apart from being gripping, there's also a lot to be learned from those fuckups, and those lessons are lost. So people keep making the same mistakes. (ie. those who ignore history ....)

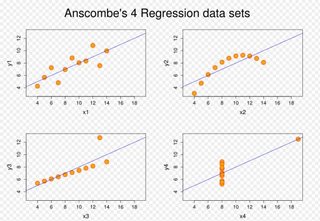

I'm always interested in novel ways to present and analyze data, and I came across this (pretty well known) example from Anscombe, which I really like.

All four of these datasets have the same ...

linear-fit : y=3+0.5 x

mean : 7.5

variance : 4.12

correlation : 0.816

Of course the moral of the story is, it's important to LOOK at your data. A lot of fuckups happen when lazy people put their trust in some automated machinery (like the TOMS ozone hole) because they figure someone else had already figured it all out.

0 Comments:

Post a Comment

<< Home